eBrand Me is a digital marketing agency offering marketing & consultative services to CPAs and tax professionals.

Following up on Ancient Egyptian Jewelry: Adornment & the Afterlife, this week we’ll discuss ancient Egyptian pottery...

Following up on Ancient Egyptian Paper: Papyrus, Parchment & Paper Money, this week we’ll discuss Ancient Egyptian...

Following up on Ancient Egypt Trade: The Nile River to the Sahara Desert, this week we’ll discuss Egyptian paper,...

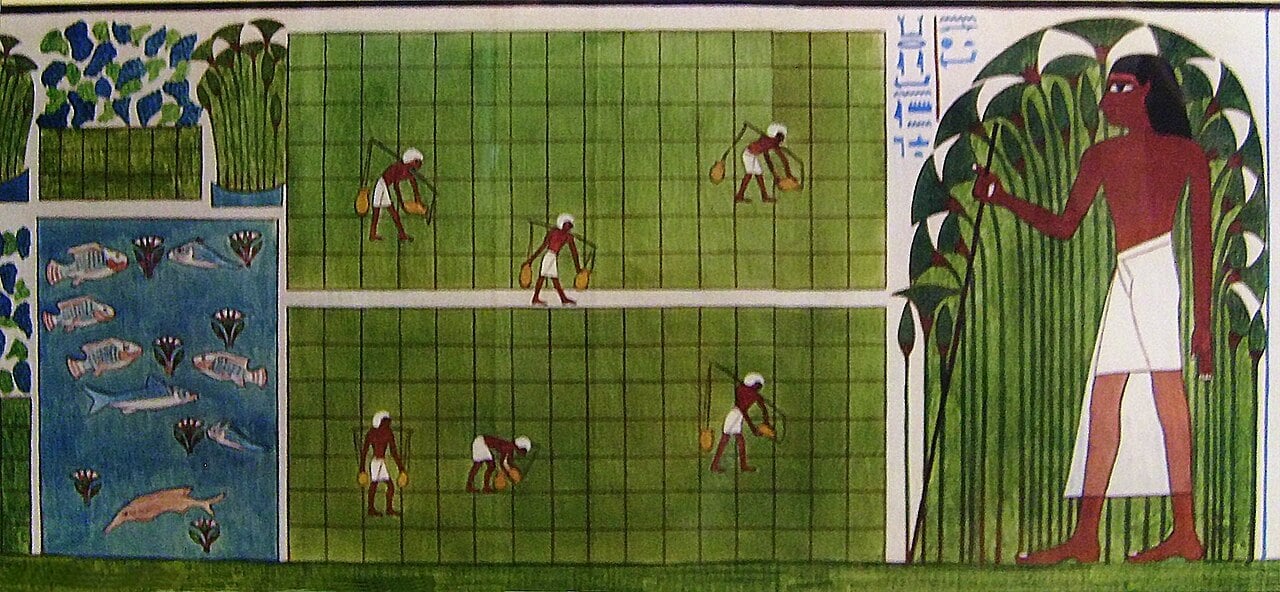

Following up on Ancient Egypt: An Agricultural Economy Indebted to the Nile River, this week we’ll discuss trade in...

Following up on Transatlantic Slave Trade: A Look from West Africa, this week we’ll discuss ancient Egypt’s economy...

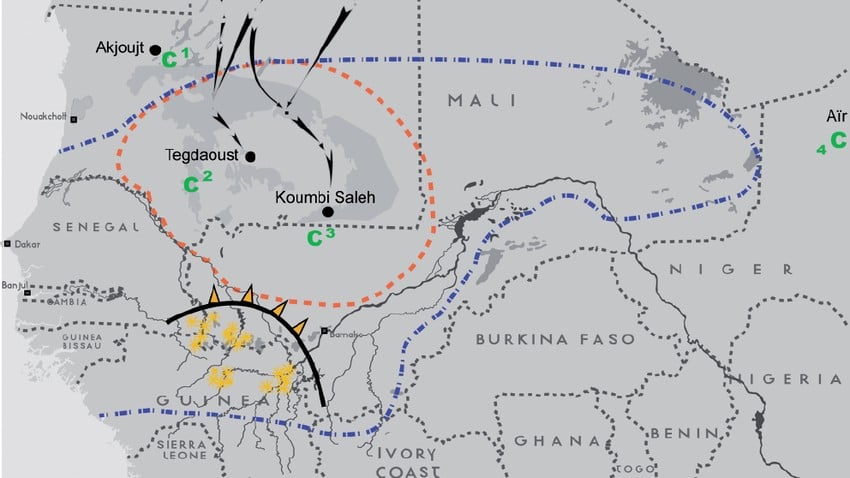

Following up on Trans-Saharan Trade Network: The Ancient Kingdom of Ghana (Wagadu), this week we’ll start to look at...

Following up on Champagne Fairs: An Important Center for European Trade, this week we’ll go back and discuss the...

Following up on Trade Routes: Kashgar, an Oasis Along the Silk Road, this week we’ll discuss the annual Champagne Fairs...

Following up on Trade Routes: Trade in Byzantine Constantinople, this week we’ll discuss trade in Kashgar, a central...

Following up on Trade Routes: Indian Ocean Trade Route, this week we’ll discuss trade in Constantinople, one of the...

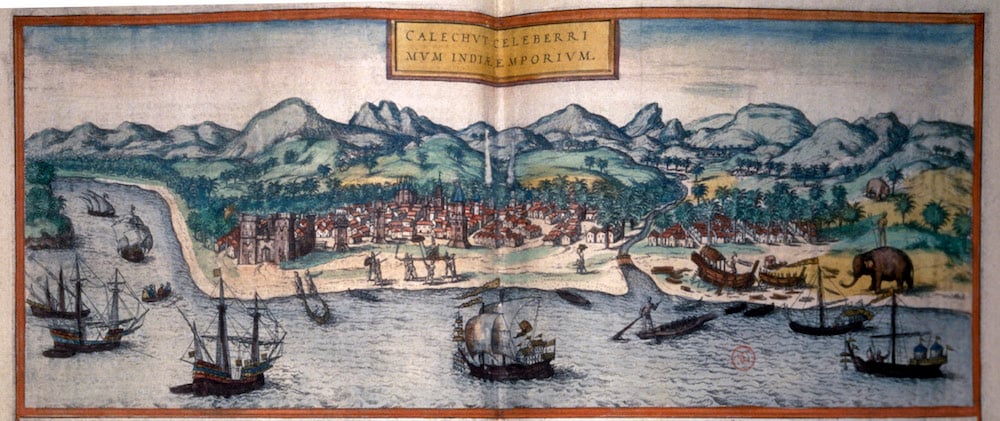

Following up on African Trade Routes: The Trans-Saharan Trade Network, this week we’ll discuss a history of the Indian...

Following up on What Will the Dominant Economic System of the Future Look Like?, this week we’ll discuss the...

Following up on Plagues: Effect on the Economy and Inequality, this week we’ll attempt to address the question, “what...

Following up on The Black Death: A Pandemic Along the Silk Road, this week we’ll how pandemics affect the economy by...

Following up on Food Economy: Historic Famines Across China, India, Ireland, Russia and the Ukraine, this week we’ll...

Following up on Chinese Economy: A Brief History of Agriculture & Irrigation, this week we’ll discuss 10 historic...

Following up on Chinese Economy: Silk Industry, this week we’ll discuss the Chinese Economy from the standpoint of...

Following up on Chinese Economy: Iron Industry, this week we’ll discuss the Chinese Economy from the standpoint of its...

Following up on Chinese Economy: The Introduction of Paper Money, this week we’ll discuss the Chinese Economy from the...

Following up on World Systems Theory: Core, Periphery, Semi-Periphery, this week we’ll discuss the Chinese Economy from...

Following up on Capitalism: The Motive to Make a Profit, this week we’ll discuss World Systems Theory.which was...

Following up on Commodities Trading 101: Investing in Silver, Gold or Water, this week we’ll discuss capitalism which...

Following up on What Is the Average Return of the US Stock Market?, this week post is a compilation of past articles on...

Following up on Long Term Investing: Buy & Hold Regardless of Short Term Fluctuations, this week we’ll discuss the US...

Following up on Stock Market Indexes 101: Tracking Public Companies, this week we’ll discuss long term investing, a buy...

According to the Library of Congress, in 1884 the first Index was created. It was originally known as the Dow Jones...

Following up on 4 Notable Market Bubbles in History, this week we’ll discuss the efficient market hypothesis (EMH)....

Following up on What Are Fractional Shares, this week we’ll discuss market bubbles and review four economic bubbles in...

Following up on Investing in Index Funds, this week we’ll discuss fractional shares, which is essentially holding a...

Following up on Shorting a Stock: What Does It Mean?, this week we’ll discuss investing in index funds, a passive...

Following up on Put Options: A Deeper Dive, when we discussed that put options give the investor the right to sell a...

Like calls, put options are a type of options contract. The difference is that they give an investor the right to sell...

Call options, in particular, gives the investor the option to purchase a security, such as a specific stock, at a...

Option trading allows you to speculate whether an asset’s price will rise or fall from its current price, how much an...

One of four financial derivatives, forward contracts, like future, don't trade on an open exchange. They can be used...

Futures contracts are typically traded on a stock exchange, which sets the standards for each contract. Regardless of...

Established on January 1, 1984, the Russell 3000, Russell 2000 and Russell 1000 indexes are maintained by the FTSE...

One of the most popular stock indexes used to small-cap stocks, the Russell 2000 is a market capitalization-weighted...

One of the broadest indices that is tracked by investors, the Russell 3000 Index contains six times as many stocks as...

In the U.S., the most broadly followed indexes are the Standard & Poor's 500 Index, the Dow Jones Industrial Average,...

The New York Stock Exchange (NYSE) has a history that goes back to 1792 when two dozen stockbrokers met on Wall Street...

The NASDAQ is the world’s first electronic stock exchange. Launched on Feb. 5, 1971, it transformed the financial...

The major U.S. market indexes are the Dow Jones Industrial Average (DJIA), the NASDAQ, and the S&P 500. The Dow Jones...

There are approximately 5,000 U.S. indexes. The three most widely followed are the S&P 500, Dow Jones Industrial...

Alpha and beta are measures used by investors to evaluate the performance and risk of an investment security or...

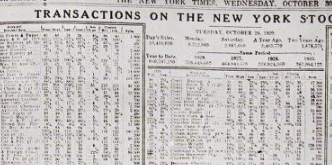

When the U.S. stock market crashed in October 1929, securities issued by numerous companies became worthless. As an...

The first leveraged buyouts started in early 1980s with high yield bonds invented by Michael Milken (commonly called...

When investing in the stock market, The Rule of 72 can be a helpful tool to give you an idea of how long it will take...

The IRS will open for business on January 29. This is the day the agency will start accepting and processing tax...

Many investors prefer to invest more aggressively at younger ages and more conservatively as they approach retirement...

Cash accounts are the default type of accounts at brokerage firms. They require that all purchases of securities be...

Cash accounts are the default type of accounts at brokerage firms. They require that all purchases of securities be...

Across all types of investments, return on investment (ROI) is more common than internal rate of return (IRR), largely...

Dollar-cost averaging, or DCA, is an investment strategy that tries to minimize your risks by making multiple purchases...

In today’s competitive environment, information is power. With these 30 tips, you'll have the beginnings of a...

The Consumer Price Index (CPI) is used to determine the rate of growth of consumer prices, better known as inflation....

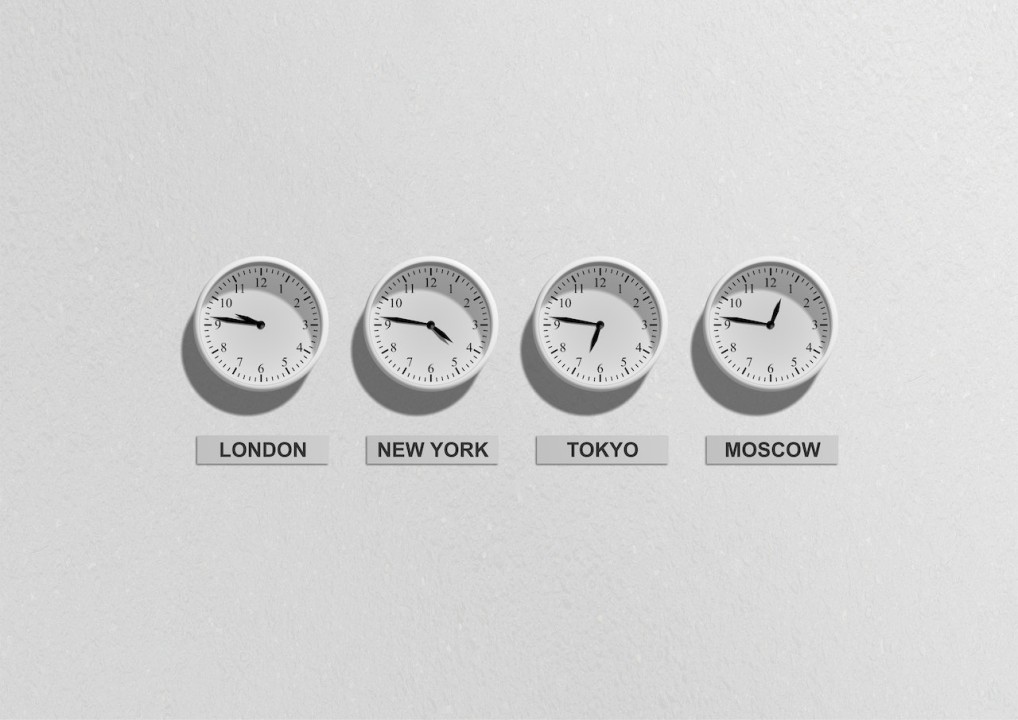

Many U.S. investors never consider the impact that changes in foreign exchange rates can have on their investments....

Like gold and silver, water is a commodity—and it happens to be a rather scare commodity.

Silver is the second most-common precious metal. It's an important industrial metal used in the electrical,...

Commodities trading (or investing) is the buying and selling raw materials such as agricultural products, livestock and...

A dividend is a distribution of a portion of a company's earnings. Companies can choose to regularly reward their...

According to the Securities Industry and Financial Markets Association (SIFMA), the global bond market was worth $126.9...

As mentioned in Growth Stocks: Industry Disruptors That Generally Do Not Pay Dividends, value stocks are seen on the...

From the railroads of the late 1800s, the invention of the automobile, the first airplane, the television, household...

Generally sold with institutional investors in mind, preferred stocks are a form of fixed-income security. Like bonds,...

Companies sell stocks to raise money, which they then use for initiatives like general corporate purposes, growth or...

Investing in stocks means buying shares of ownership in a public company with the goal yielding higher returns when...

Investing is a way to make your money work so that it's worth more tomorrow than today. It means buying and holding...

One reason that you may decide to sell your NFT is because it appreciated in value. When calculating your possible...

Created in 2012, Colored Coins are considered the first step towards Non-Fungible Tokens (NFTs). We discussed that NFTs...

We discussed that Non-Fungible Tokens (NFTs) aren’t actual cryptocurrencies but instead tokens on a blockchain that...

Non-Fungible Tokens (NFTs) are tokens on a blockchain that represent ownership of a digital creation such as art,...

Since cryptocurrencies are decentralized and not under the control of financial institutions, proof-of-stake (PoS) and...

In a publishing by Keith Black, PhD, CFA®, CAIA®, FDP, he states that while there are more than 20,000 cryptocurrencies...

According to a 2020 publication by Acuant, the number of people unbanked globally was listed at more than 2 billion....

Remember Investing 101: How Investing Works? This week, I present to you Blockchain 101. I recommend that you bookmark...

One of the most important features of blockchain is that the data it holds is not stored in a centralized location....

According to Fool, “Smart contracts are programs written on the blockchain that self-execute when certain conditions...

This week, we’ll cover the advantages and drawbacks of investing in cryptoassets. Why would anyone choose...

With more than 20,000 cryptocurrencies in circulation—Bitcoin, Ethereum, Tether, Cardano, Solana—you should know that a...

Currently, there are more than 20,000 cryptocurrencies in circulation from Bitcoin, Ethereum, Tether, Cardano, Solana,...

Cryptoassets include cryptocurrencies, stablecoins, tokens, and other digital assets. More than 20,000 different...

This post is a compilation of recent articles and covers topics such as value investing, the stock market crash of...

When you own a stock, you’re a partner with an expanding business. With the purchase of a bond, you’re essentially...

A bear market is generally defined as a decline of 20% or more in a major market index like the S&P 500 or the Dow...

Warren Buffett, also known as the Oracle of Omaha, began buying shares of Berkshire Hathaway in 1962. He picked them up...

The essential task of a value investor is to determine the intrinsic value of a security in order to take advantage of...

Value investing, as defined by Benjamin Graham, is a strategy of buying securities only when their market prices are...

What is fundamental analysis?

Throughout the 1920s, the New York Stock Exchange (NYSE) served as the financial heart of the United States.

FOR IMMEDIATE RELEASE: October 13, 2022

SIGN UP FOR THE LATEST POSTS FROM EBRAND ME

Receive notifications of new posts by email.

Notable People in History Podcast

Come along with me and explore the lives of Archimedes, Autherine Lucy, Abraham Lincoln, Cleopatra, Thomas Edison, Harriet Tubman, Galileo Galilei, Madeleine Albright, Albert Einstein, Wangari Maathai, Ctesibius, Valentina Tereshkova, Chiune Sugihara, … and others who’ve greatly influenced society.

Wang Zhenyi: Astronomer, Mathematician, and Poet

In this week's Notable People in History podcast, we’ll take a look at the life of Wang Zhenyi. Despite societal norms which prohibited female education, she made accurate findings and observations as to the relationship between the lunar and solar eclipses.

%20Composite%20Index.png)

.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)