Investing in Bonds: Portfolio Diversification, Market Size, Credit Rating

According to the Securities Industry and Financial Markets Association (SIFMA), the global bond market was worth $126.9 trillion at the end of 2021, compared to the $124.4 trillion global equity market cap.

Bonds are a way for an organization to raise money. When an investor buys a company's stock, that person is buying a percentage of ownership in that company.

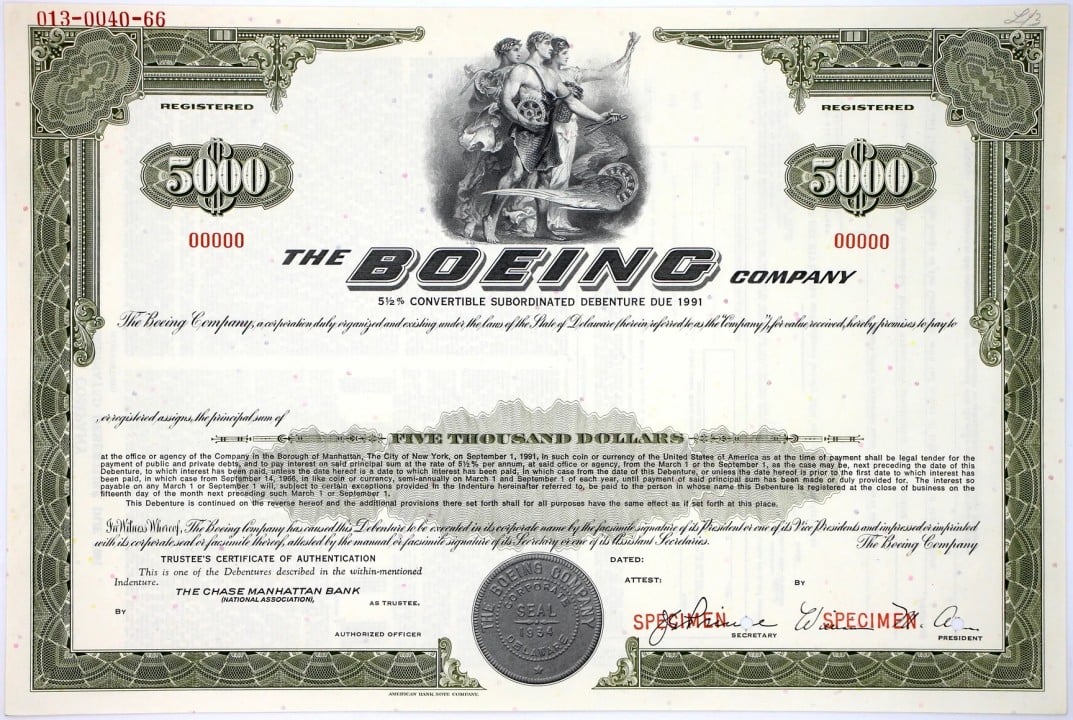

The purchase of a bond is essentially a loan made by an investor to a company for a predetermined period that include details about interest rates, payment dates, and other terms including its maturity date.

The company or government entity (borrower) agrees to pay back the loan on a particular future date and make the interest payment to the bond holders. This is generally referred to as the coupon throughout the life of the loan.

Bonds are usually traded over-the-counter (OTC) with a face value of $1,000, also called its par value. They’re sold for a fixed term, typically from one year to 30 years. Longer term bonds usually pay higher coupons due to risk associated with the increased length of the lending commitment.

Not all bonds pay interest. Some bonds, known as zero-coupon bonds, offer a return once they’ve matured. Since they don’t pay interest, these zero-coupon bonds usually sell for a deep discount to their face value.

Bonds can be purchased through an online broker, on the secondary market from investors wanting to sell, through mutual funds, exchange-traded funds (ETFs) that invests solely in bonds or directly from the government via the Treasury Direct website.

When considering which bonds to buy, investors should assess whether the borrower is likely to be able to pay back the money with interest. Credit quality of the bond issuer can be determined through Moody's, Fitch, and Standard & Poor's.

You can sell a bond on the secondary market before it matures, but you run the risk of not making back your original investment, or principal. When a bond is trading for less than the face value, it's said to be selling at a discount. When trading for a price above face value, the bond is selling at a premium.

There are several types of bonds available, including:

- Corporate bonds: These tend to offer higher interest rates than other types of bonds, but the companies that issue them are more likely to default than government entities.

- Municipal bonds: Also called muni bonds, these are issued by states, cities, and other local government entities to finance public projects or offer public services.

- Treasury bonds: Nicknamed T-bonds, these are issued by the U.S. government. Because of the lack of default risk, they don't have to offer the same (higher) interest rates as corporate bonds.

Some bonds are callable, which means the company or government can repay them before they reach maturity, usually at a specified price.

Bonds offer diversification to a portfolio. The regular interest paid can be a source of income for living expenses. They have an inverse relationship in to stocks — when stock prices rise, bonds prices fall. Your stock/bond allocation comes down to risk tolerance.

Both stock and bonds can play a critical role within a long term investment strategy. If a company files for bankruptcy, secured debt holders are first in line to be paid.

Financial Industry Regulatory Authority (FINRA) regulates the bond market to some extent by posting transaction prices as that data becomes available.

---

Ready to invest in digital marketing for your business? Let's work together to create a plan designed around optimizing your business directory listings, while incorporating search engine optimization (SEO), content marketing, search engine marketing, lead generation and website design to ensure that your accounting practice is optimized to help you reach your goals.