Black Tuesday: Vanished Hopes on Wall Street

Throughout the 1920s, the New York Stock Exchange (NYSE) served as the financial heart of the United States.

Monday through Friday, hundreds of stockbrokers crowded the trading floor waiting for the brass bell to ring, signaling the start of the trading day at 10am.

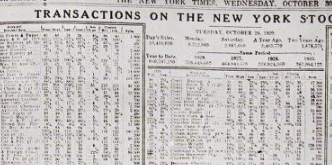

Black Tuesday took place on October 29, 1929, the sharp drop in stock prices symbolized the end of the Roaring Twenties and the beginning of a decade of hardship.

During the 1920s, electricity powered more and more of the nation’s factories, increasing productivity. With increased productivity, workers worked shorter hours and by the end of the 1920s, the number of hours worked weekly in US factories decreased from 60 to 48.

Henry Ford perfected the assembly line in his automobile factory. The popularity of the automobile boosted various secondary industries, such as rubber, steel, and gas. Food stands, camping sites and gas stations sprang up along new freshly paved road and highways.

Many Americans had more time and money than ever before. They believed that the US economy would continue to boom. The Roaring Twenties marked the beginning of the habit of buying on credit and by the late 1920s, more Americans were buying stocks on credit than ever before.

By 1927, banks had loaned stockbrokers more than $3.5 billion which they used to cover the cost of margin trading. By the summer of 1929, an estimated 1 million Americans had bought stocks on margin… many of these investors would lose everything.

The Federal Reserve Board stepped in late 1928 and early 1929, raising interest rates and the fees charged to borrow money hoping to discourage people from buying on margin and speculating on stocks. Americans continued to invest in the stock market, believing that the price of stocks would continue to rise.

Nearing the end of summer 1929, the stock market was more unstable than ever. Radio Corporation of America had seen its stock rise by 500% since March 3, 1928. On September 5th, stocks prices plummeted in what became known as the Babson Break.

By mid-September, stock prices rose to record highs not reached again until the 1950s. They began to decline again by October, yet the money loaned by banks to brokers for margin purchases soared, reaching $6.8 billion.

On October 23rd, 1929, thousands of Americans began selling off their stock to save some of their investments. Stocks purchased on margin, no longer worth the money borrowed and paid for were now due.

The conventional wisdom is that speculation was the cause of stock prices being too high. For example, Commonwealth Edison traded for $35 at its highest price in 1929, was availble for purchase at $3.31.

Almost as soon as the opening bell sounded on October 29, 1929, brokerage firms, banks and companies sold off a mass of stocks. In the first half hour, three million shares were traded. Throughout the day, investors traded a record 16.4 million shares. They lost $14 billion on the NYSE. Between October 23 and October 31, 70.8 million shares exchanged hands.

The Dow Jones Industrial Average continued sliding for three more years. It finally bottomed on July 8, 1932, closing at 41.22.

Leading to the collapse were the events of October 24, 1929 (Black Thursday), when stocks plummeted but rebounded the following day. The Dow had dropped almost 12% closing at 230.

Losses from the stock market crash helped create the Great Depression, a 10-year economic slump that affected all industrialized countries in the world.

People withdrew all their savings at once. Many banks didn't have enough cash on hand and were forced to close. There was no Federal Deposit Insurance Corporation (FDIC) to insure savings. Investors abandoned the stock market and started putting their money in commodities. As a result, gold prices soared.

By November 13, three weeks after Black Tuesday, the market had fallen to its lowest point. Nearly 2 million people were unemployed by March 1930, many as a result of the crash.

The Great Depression would continue throughout the 1930s and ended after the United States entered World War II in 1941.

---

Ready to invest in digital marketing for your business? Let's work together to create a plan designed around optimizing your business directory listings, while incorporating search engine optimization (SEO), content marketing, search engine marketing, lead generation and website design to ensure that your accounting practice is optimized to help you reach your goals.