eBrand Me is a digital marketing agency offering marketing & consultative services to CPAs and tax professionals.

Following up on Food Economy: Historic Famines Across China, India, Ireland, Russia and the Ukraine, this week we’ll...

Following up on Chinese Economy: A Brief History of Agriculture & Irrigation, this week we’ll discuss 10 historic...

Following up on Chinese Economy: Silk Industry, this week we’ll discuss the Chinese Economy from the standpoint of...

Following up on Chinese Economy: Iron Industry, this week we’ll discuss the Chinese Economy from the standpoint of its...

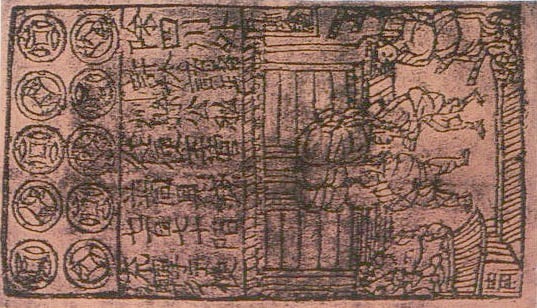

Following up on Chinese Economy: The Introduction of Paper Money, this week we’ll discuss the Chinese Economy from the...

Following up on World Systems Theory: Core, Periphery, Semi-Periphery, this week we’ll discuss the Chinese Economy from...

Following up on Capitalism: The Motive to Make a Profit, this week we’ll discuss World Systems Theory.which was...

Following up on Commodities Trading 101: Investing in Silver, Gold or Water, this week we’ll discuss capitalism which...

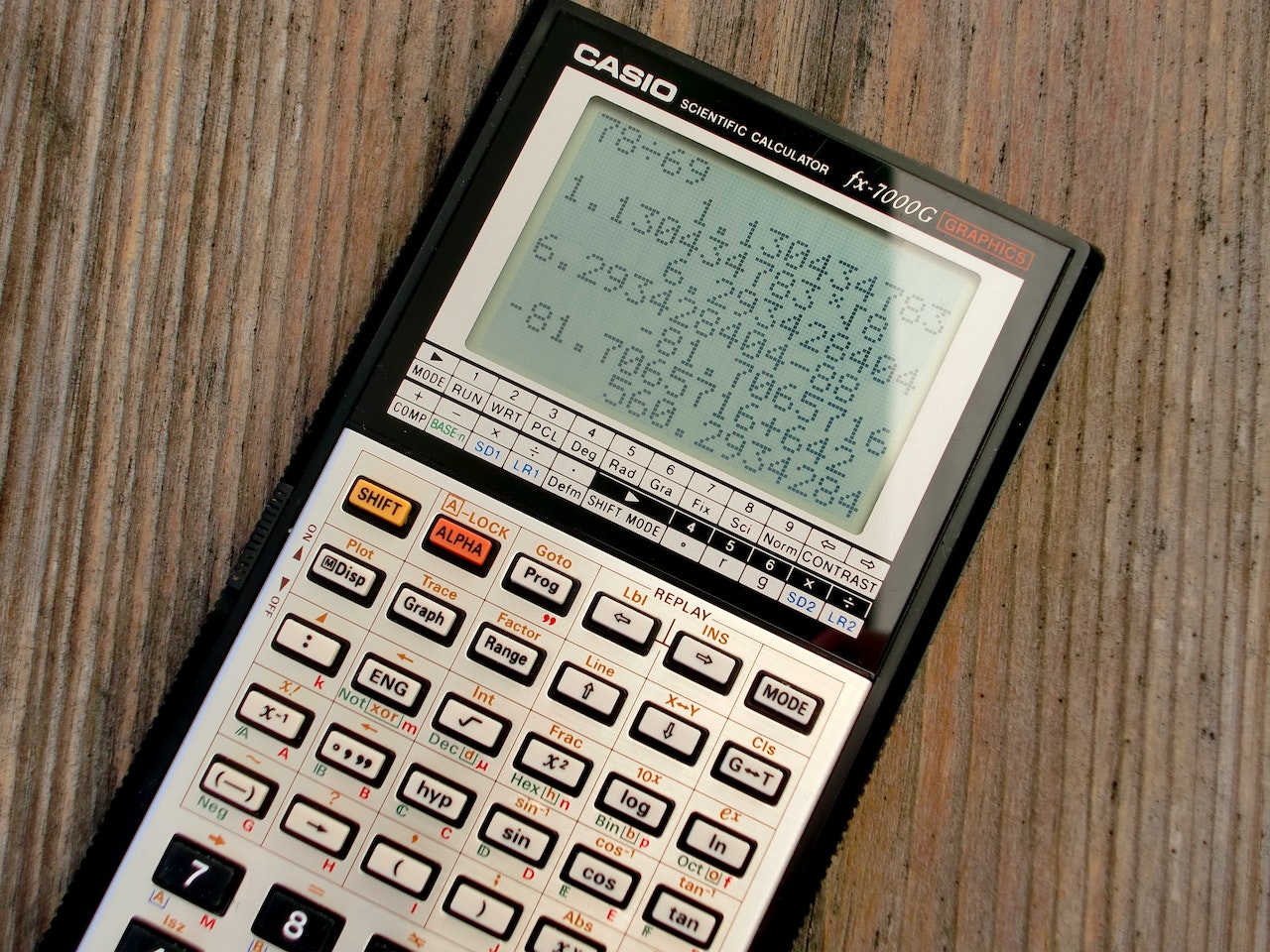

Following up on What Is the Average Return of the US Stock Market?, this week post is a compilation of past articles on...

Following up on Long Term Investing: Buy & Hold Regardless of Short Term Fluctuations, this week we’ll discuss the US...

SIGN UP FOR THE LATEST POSTS FROM EBRAND ME

Receive notifications of new posts by email.