eBrand Me is a digital marketing agency offering marketing & consultative services to CPAs and tax professionals.

Following up on Ancient Egyptian Jewelry: Adornment & the Afterlife, this week we’ll discuss ancient Egyptian pottery...

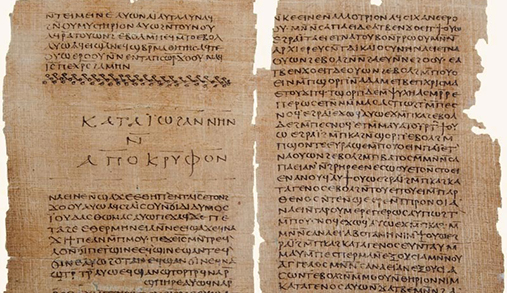

Following up on Ancient Egyptian Paper: Papyrus, Parchment & Paper Money, this week we’ll discuss Ancient Egyptian...

Following up on Ancient Egypt Trade: The Nile River to the Sahara Desert, this week we’ll discuss Egyptian paper,...

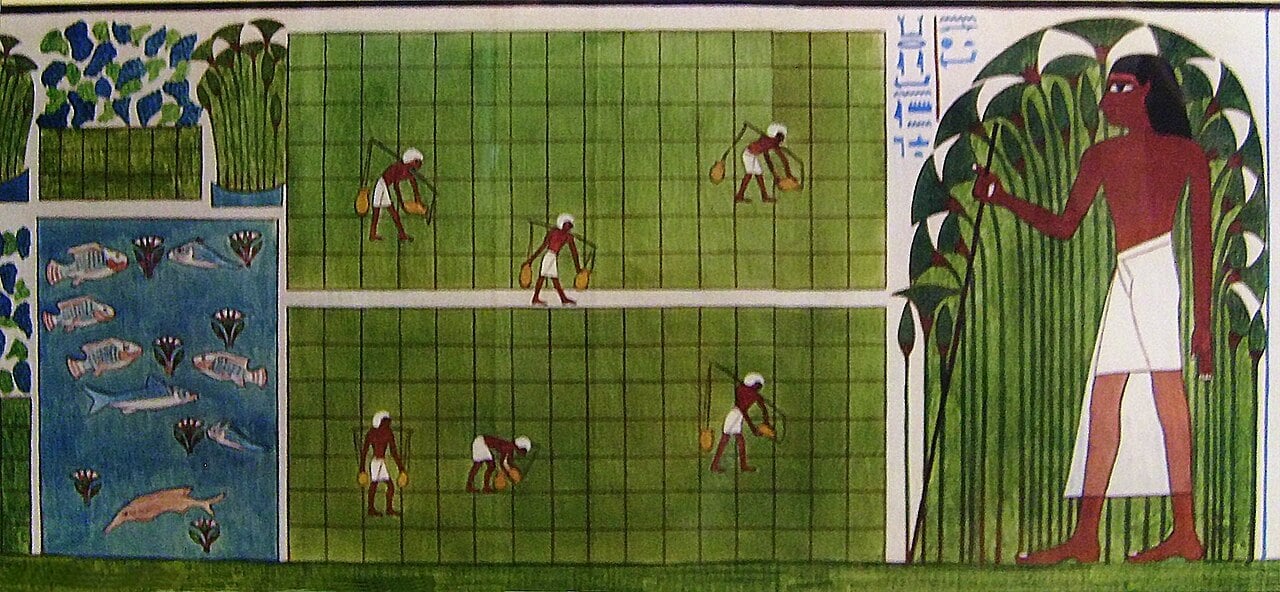

Following up on Ancient Egypt: An Agricultural Economy Indebted to the Nile River, this week we’ll discuss trade in...

Following up on Transatlantic Slave Trade: A Look from West Africa, this week we’ll discuss ancient Egypt’s economy...

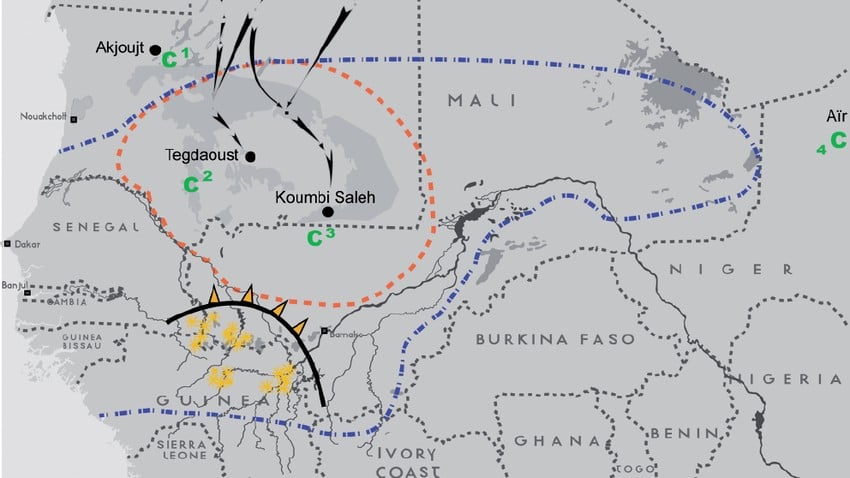

Following up on Trans-Saharan Trade Network: The Ancient Kingdom of Ghana (Wagadu), this week we’ll start to look at...

Following up on Champagne Fairs: An Important Center for European Trade, this week we’ll go back and discuss the...

Following up on Trade Routes: Kashgar, an Oasis Along the Silk Road, this week we’ll discuss the annual Champagne Fairs...

Following up on Trade Routes: Trade in Byzantine Constantinople, this week we’ll discuss trade in Kashgar, a central...

Following up on Trade Routes: Indian Ocean Trade Route, this week we’ll discuss trade in Constantinople, one of the...

SIGN UP FOR THE LATEST POSTS FROM EBRAND ME

Receive notifications of new posts by email.